Estate planning isn’t just for the ultra-wealthy it’s a critical step for anyone who wants to protect their assets and ensure their loved ones are taken care of. One of the most effective tools for this is a trust, a legal arrangement that allows you to control how your assets are distributed during your lifetime and after your passing.

But many people wonder: at what net worth does it actually make sense to create a trust? The answer isn’t one-size-fits-all.

Factors such as the types of assets you own, your family situation, and your financial goals all play a role. In this article, we’ll explore when a trust becomes necessary, the benefits it offers, and practical guidance for deciding if it’s right for you.

By understanding these key considerations, you can make informed choices that protect your legacy and provide peace of mind for your family.

Understanding Trusts

A trust is a legal arrangement in which one person, called the settlor, transfers assets to a trustee, who manages those assets for the benefit of one or more beneficiaries. Unlike a will, which only goes into effect after your death, certain types of trusts—such as living trusts—can take effect immediately, providing more control over your assets while you’re alive.

There are several types of trusts, each serving different purposes. Revocable trusts can be modified or revoked during your lifetime, offering flexibility if your circumstances change. Irrevocable trusts, on the other hand, generally cannot be changed once established, but they offer stronger protection against creditors and may provide tax benefits. Testamentary trusts are created through a will and only take effect after death, whereas specialized trusts—like charitable trusts or trusts for minors—serve unique goals, such as supporting a charitable cause or protecting a child’s inheritance until they reach adulthood.

Trusts are not just for the ultra-wealthy. They can help families of all net worth levels avoid probate, maintain privacy, and ensure assets are distributed according to specific wishes. They also allow you to plan for unexpected events, like incapacity, ensuring your finances are managed properly if you cannot make decisions yourself. Understanding the types and benefits of trusts is the first step in determining whether one is right for your financial situation.

How Net Worth Influences the Need for a Trust

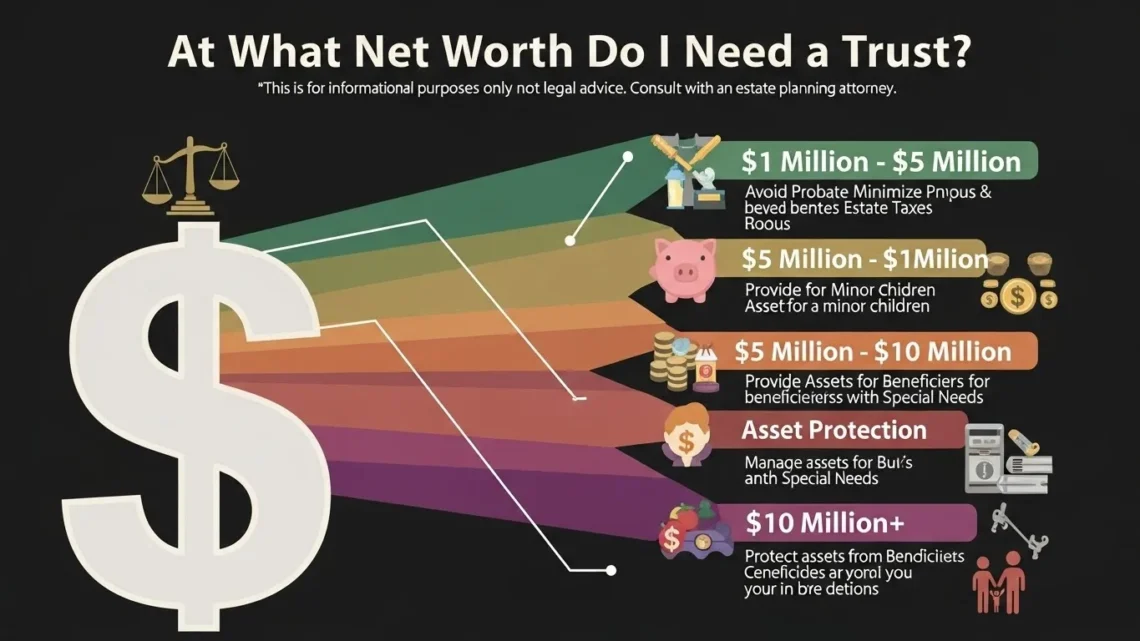

One of the most common questions people ask when considering a trust is whether their net worth justifies it. While there’s no universal dollar threshold, your overall assets, their complexity, and your personal circumstances all play a role in deciding if a trust is necessary. Generally, individuals with a moderate to high net worth—often $100,000 or more in combined assets—may benefit from creating a trust, though even smaller estates can sometimes gain advantages depending on the situation.

It’s not just about the total value of your assets. The types of assets you own matter significantly. Real estate, investment portfolios, business interests, and retirement accounts all require different levels of planning. For example, owning multiple properties or a family business can complicate the probate process, making a trust more beneficial even at a lower net worth.

Family structure also impacts the decision. Blended families, minor children, or dependents with special harmfulmay require a trust to ensure assets are distributed according to your wishes and protected from potential disputes. Additionally, state laws can influence whether probate is time-consuming or costly, making trusts a more practical choice in certain regions.

Ultimately, deciding whether you need a trust involves evaluating both your financial situation and personal goals. While net worth is an important factor, it’s one piece of a larger estate planning puzzle that includes family, assets, and long-term intentions.

Benefits of Having a Trust

Creating a trust offers a variety of benefits that go beyond simply managing wealth. One of the most significant advantages is avoiding probate, the often lengthy and costly court process required to validate a will. By placing assets in a trust, your property can pass directly to beneficiaries, saving time, reducing legal fees, and preventing potential disputes among heirs.

Trusts also provide a higher level of privacy compared to a will. Since wills become public records during probate, anyone can access the details of your estate. In contrast, trusts remain private, keeping your financial matters and the distribution of assets confidential. This can be particularly valuable for families with sensitive or high-profile assets.

Another key benefit is control over asset distribution. Trusts allow you to specify when and how beneficiaries receive their inheritance, which can be crucial for minor children, young adults, or individuals who may not be financially responsible. For example, you could stagger distributions over time or set conditions for access to funds.

Trusts can also offer asset protection and tax planning advantages. Certain irrevocable trusts shield assets from creditors and lawsuits, while some trusts can help minimize estate or gift taxes.

Ultimately, a trust provides peace of mind, ensuring that your assets are managed and distributed according to your wishes, even if you become incapacitated or pass away unexpectedly. Whether your goal is simplicity, privacy, protection, or control, a trust is a versatile tool that can benefit a wide range of families and estates.

Situations Where You Might Not Need a Trust

While trusts offer many advantages, they are not always necessary for every individual or family. Understanding situations where a trust may not provide significant benefits can help you make a more informed estate planning decision.

For starters, smaller or simple estates may not require a trust. If your assets are limited, easy to manage, or can be transferred directly through beneficiary designations—like life insurance policies, retirement accounts, or payable-on-death (POD) bank accounts—a trust might add unnecessary complexity and cost. In such cases, a well-prepared will combined with these accounts can adequately distribute your assets.

Another scenario involves straightforward family structures and asset ownership. If you have a single spouse or a small number of heirs and few properties or investments, the probate process may be manageable, making a trust less critical. Simple estates with clear heirs often do not face disputes or prolonged court proceedings.

Alternative planning tools can also reduce the need for a trust. Joint ownership of property, POD accounts, and other transfer-on-death arrangements can achieve many of the same goals, such as avoiding probate and ensuring timely distribution to beneficiaries, without establishing a formal trust.

Ultimately, the decision to create a trust depends on balancing complexity, cost, and benefits. While trusts are powerful tools for many, they are not a one-size-fits-all solution. Evaluating your net worth, family situation, and specific estate planning goals can help determine if a trust is truly necessary or if simpler strategies may suffice.

Steps to Setting Up a Trust

Setting up a trust may seem complicated, but breaking the process into clear steps can make it manageable. The first step is choosing the right type of trust. Depending on your goals, you might select a revocable living trust for flexibility, an irrevocable trust for stronger asset protection, or a specialized trust such as one for minor children or charitable purposes. Understanding the differences is essential to match the trust to your harmful.

Next, you need to choose a trustee. The trustee is responsible for managing the trust assets and ensuring they are distributed according to your instructions. You can appoint a trusted family member, a close friend, or a professional trustee, such as a bank or attorney. The choice depends on the complexity of the trust, your family dynamics, and the trustee’s experience.

Once you’ve selected the trust type and trustee, the funding process begins. Funding a trust involves transferring ownership of your assets—such as bank accounts, real estate, investments, or business interests—into the trust. Assets not properly transferred may still go through probate, defeating one of the trust’s primary benefits.

Finally, it’s important to seek legal and financial advice. Working with an estate planning attorney ensures the trust complies with state laws and accurately reflects your wishes. Financial advisors can help align your trust with broader estate planning and tax strategies.

Following these steps ensures your trust is legally sound, properly funded, and tailored to protect your assets and beneficiaries effectively, giving you peace of mind for the future.

Common Misconceptions About Trusts

Despite their growing popularity, trusts are often misunderstood. One of the most common misconceptions is that trusts are only for the ultra-wealthy. While high-net-worth individuals certainly benefit from trusts, people with moderate assets can also gain advantages such as avoiding probate, maintaining privacy, and ensuring assets are distributed according to their wishes. Trusts are versatile tools, not exclusive to millionaires.

Another myth is that trusts eliminate all taxes. While certain irrevocable trusts may provide tax planning benefits, no trust completely removes tax obligations. Estate and gift taxes can still apply, depending on the size of the estate and the trust type. Understanding the limitations is important to set realistic expectations.

Many people also believe that trusts are prohibitively expensive or complicated to create. While there is a cost to establish and maintain a trust, it is often outweighed by the long-term benefits, such as avoiding probate fees, protecting assets, and preventing disputes among heirs. Additionally, a well-prepared trust can simplify estate management rather than complicate it.

Finally, some think that creating a trust eliminates the need for a will entirely. In reality, a trust typically works alongside a “pour-over” will, which ensures any assets not transferred into the trust during your lifetime are still distributed according to your wishes.

By understanding these common misconceptions, you can make informed decisions about whether a trust is right for you and avoid unnecessary confusion or hesitation in your estate planning process.

FAQs:

1. How much net worth do I need to justify a trust?

There’s no strict threshold, but many experts suggest considering a trust once your net worth reaches $100,000 or more, especially if you own real estate, investments, or other complex assets. Family circumstances and estate planning goals can make trusts valuable even at lower net worth levels.

2. Can a trust protect my assets from creditors?

Certain irrevocable trusts offer protection from creditors and lawsuits, but revocable trusts generally do not. Choosing the right type of trust is crucial for asset protection.

3. Do I still need a will if I have a trust?

Yes. A “pour-over” will ensures any assets not placed into the trust during your lifetime are still distributed according to your wishes.

4. How much does it cost to set up a trust?

Costs vary depending on complexity and legal fees but can range from a few hundred to several thousand dollars. Long-term benefits like avoiding probate and maintaining privacy often outweigh the initial expense.

5. Can I change or revoke my trust later?

Revocable trusts can be modified or revoked at any time, while irrevocable trusts generally cannot. Choose carefully based on your goals and flexibility harmful.

Conclusion

Determining If you need a trust depends on more than just your net worth. While higher-value estates often benefit from trusts, factors such as asset complexity, family circumstances, and estate planning goals play an equally important role.

Trusts provide key advantages, including avoiding probate, maintaining privacy, controlling asset distribution, and offering potential tax or asset protection benefits.

However, they are not always necessary for simpler estates, and alternative planning tools may suffice in some cases.